By David Jacobson, Temblor

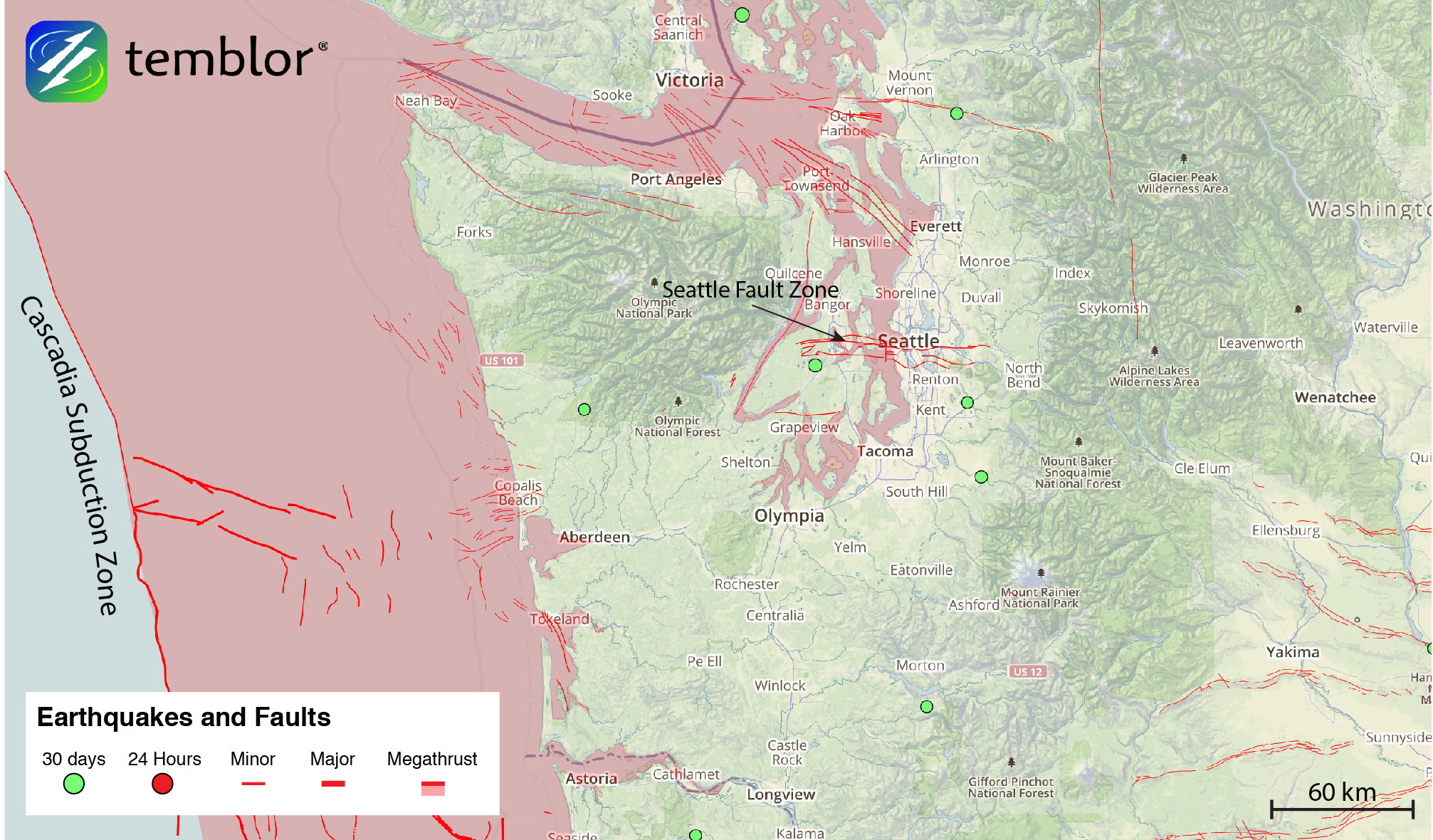

The hazards of the Pacific Northwest

The state of Washington has a significant earthquake hazard. From the Cascadia Subduction Zone, which extends from Vancouver Island to Cape Mendocino, to the Seattle Fault Zone that runs underneath Puget Sound and the city of Seattle, millions of people are exposed. One of the main ways in which people can protect themselves is through earthquake insurance. In a document released this week by the Washington Insurance Commissioner, the percentage of residential earthquake insurance policies was revealed for the first time.

Because of their proximity to hazards, it comes as no surprise that 90% of the exposure is west of the Cascade Mountain Range, predominantly in the cities of Seattle, Olympia, and Tacoma. This region last saw a large earthquake in the 2001 M=6.8 Niqually quake, which did over $2 billion in damage, $305 million of which was insured. Nevertheless, in the event of a Cascadia Subduction Zone earthquake, which could exceed M=9.0, the amount of damage could be catastrophic.

Additionally, many scientists compare what the Seattle Fault could do to Seattle to what happened in Christchurch, New Zealand in 2011, when a M=6.3 earthquake resulted in over $33 billion in damage to the city. It is these more local hazards that Bill Steele, the Director of Outreach & Information Services at the Pacific Northwest Seismic Network believes deserve more attention. “The national exercise ‘Cascadia Rising’ drove even more consciousness towards Cascadia and gave it more focus than is warranted” he said in an interview. Couple this with Kathryn Schultz’s The Really Big One in The New Yorker and most people around the country know about Cascadia. However, he said that “especially in the Puget Sound area a Seattle Fault earthquake is the worst-case scenario.” Therefore, understanding the potential hazard and ways to mitigate losses is important for residents of the Evergreen State.

Earthquake insurance coverage rate exceeds expectations

According to the state commissioner, the coverage rate of earthquake insurance across the entire state came in at an unexpectedly high 11.3%. West of the Cascades, that rate is 13.8%. While this may seem low, it is only slightly less than the rate of uptake in California, a state with a much higher rate of earthquakes. However, the question then becomes, are enough people covered? Unfortunately, the answer appears to be no.

Exposure far greater than coverage

In the entire state of Washington, the exposure of earthquake-insured residential properties is $181 million. That may seem like a lot, but it is only 18% of the total general insurance coverage reported. This means that in the event of a large Pacific Northwest earthquake, many people will be forced to pay for the damage out of pocket. It should also be pointed out that for commercial coverage, the opposite is the case, as 85% of exposed properties have earthquake coverage. Nevertheless, what this shows is that not enough people are covered in the event of an earthquake.

Where are people covered?

The figure above shows a comparison between the percentage of insurance policies with earthquake coverage, and the likely earthquake magnitude in your lifetime across Washington. This highlights how the majority of the coverage lies where the hazard is highest. Nearly the entire part of the state west of the Cascades is susceptible to experiencing a M=6.25+ earthquake. Such an event could be devastating to homeowners. Why then, if there is such a likelihood of a damaging event is the level of coverage so low? The answer may be simple: cost.

Cost preventing coverage

In the report released by the insurance commissioner, it states that “property value is a strong predictor of which properties are covered by earthquake insurance.” In Washington, homes with earthquake insurance are “65% higher in value than the average insured home.” This indicates that there is likely an affordability issue for residents with more modest homes.

Further complicating the issue is that according to a Seattle Times article from December 2016, insurance companies in Washington hold all the power. For example, if an insurance company does not like terms set by the insurance regulator, they can choose to just not offer earthquake insurance. This means that what they want, they often get. In the case of State Farm, it meant significantly increasing premiums across the state, in some instances, by up to 117% in Grays Harbor and Pacific counties (the two counties on the coast with the lowest uptake rate). Such cost is why Bill Steele does not have earthquake insurance. When he purchased his home, he focused on the safety of his family, which meant retrofitting. However, he did say that with more money, he definitely would definitely carry insurance. Therefore, for many people, wanting earthquake insurance may not be enough.

References

Washington State Office of the Insurance Commissioner Report – Link

Seattle Times

Personal Communication with Bill Steele – Director of Outreach & Information Services at the Pacific Northwest Seismic Network

- Beware quiet segments of the Philippine Fault - May 16, 2025

-

ډیری عوامل افغاني ټولنې د زلزلې پر وړاندې زیانمنوي

- August 11, 2022 - What’s happening this week in Humboldt County, California: The squeeze - February 6, 2019