Interested in earthquake insurance? (Click Here)

Frequently asked questions:

Do I have earthquake insurance?

Unless you purchased earthquake insurance separately from your homeowners insurance, the answer is probably no. Most homeowners policies don’t cover earthquake damage.

Do I need earthquake insurance/should I have earthquake insurance?

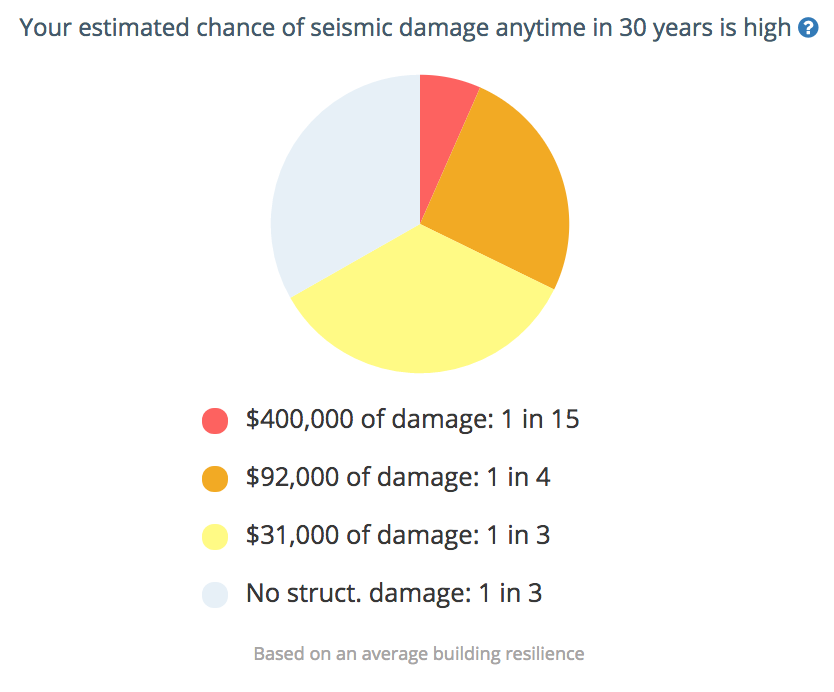

No one is required to carry earthquake insurance. However, if you live in an area susceptible to damaging earthquakes, it would provide you a way to protect what is likely your most valuable asset. To see what your risk of damaging earthquakes is, click here.

How much is earthquake insurance?

The cost of earthquake insurance is dependent on several factors including your home’s location, age, size, number of stories, and type of foundation. In California, the statewide average is about $800 annually, while in other states, the cost varies. To get in touch with an insurance agent to find out how much it would cost to get earthquake insurance, click here.

Is earthquake insurance worth it?

In order to determine if earthquake insurance is worth it, several factors need to be considered:

• What your earthquake risk is. Click here to find out.

• How much it would it cost to insure your home?

• How long will you be in the area? The longer, the more likely it is that insurance will be worth it.

• What other mitigation options are there (e.g. retrofitting)?

More information on earthquake insurance

For many of us, earthquakes are inevitable. While we know where the hazard is high, we don’t know when any quake will strike, or how damaging it will be. By buying earthquake insurance, you can greatly reduce—but not eliminate—your financial losses. Insurance can keep you solvent, and will minimize the disruption to your home and work life after a large quake. if an earthquake is declared a federal disaster area, grants and loans from FEMA have been surprisingly low (less than $30,000), and so these almost never cover your full losses.

It’s critical that you know that homeowners or renters insurance does not cover earthquake damage. Earthquake insurance must be purchased separately from one of many private providers. In California, there is also a privately-funded but publicly-managed provider. You should also know that if an earthquake triggers a fire, then your home insurance will likely cover that cost; similarly, if your home is flooded due to an earthquake or tsunami, then only flood insurance will often cover this cost.

While retrofitting your home is a viable option for many, for others, it may be more beneficial to purchase insurance, or to get both. Which is the best option for you is highly dependent on your location (open the Temblor app in your home, or enter your address), whether you are in a liquefaction and landslide zone, which can make retrofit prohibitively expensive (turn on those layers in Temblor), on your home age and construction type (choose those attributes in Temblor after pressing the ‘Risk’ button).

An earthquake-knowledgeable insurance agent can find you the best offer among competing providers given your circumstances. Here are the decisions you need to make when buying insurance:

Questions about your plans and finances

• How much equity do you have in your home? The greater your home equity, the more important it is to protect it.

• How much of your assets are the value of your home? The greater its importance, the more it should be protected.

Questions about the insurance policy

• The most basic policies cover only your house. Do you also want coverage for accessory structures , such as a detached garage, swimming pool, or retaining walls? Are there any exclusions or limitations to coverage? Some policies have an upper limit. In Temblor, you can estimate the home replacement value by its square footage times the cost per square feet.

• The deductible is the amount you must cover out-of-pocket before the insurance kicks in. While 15% deductible polices are most common, they can range from 5% (that’s $25,000 on a $500,000 home replacement cost) to 25% ($125,000 on a $500,000 home). Beware of ‘Total Insured Value’ policies, because their effective deductible is higher than it seems. In these policies, the deductible percentage is taken on the home replacement cost plus the personal property plus the loss of use. A 15% deductible in a replacement cost policy ($75,000) can become a $125,000 deductible if the amounts for personal property and loss of use are large.

• Will your policy pay for additional living expenses (‘Loss of Use’) if your home is destroyed or too badly damaged for you to live there before repairs are made? You could need a place to live for a year, and rental prices will likely spike because demand will outpace the supply. So, loss of use is a key value of earthquake insurance, and should not be skimped.

• Will your policy pay for damage to the contents of your home (called ‘Personal Property’), such as electronics, china, and glassware? When choosing the Personal Property amount, focus on the valuable but fragile objects in your home.