Ross Stein, Temblor

Answer: They are the ‘one percent.’

That is, they have a 1% chance per year of occurring, equivalent to 1 chance in 10 in a decade. When events of this rarity strike land or coastlines, they do tremendous damage, and so make headlines.

Neither common nor extremely rare

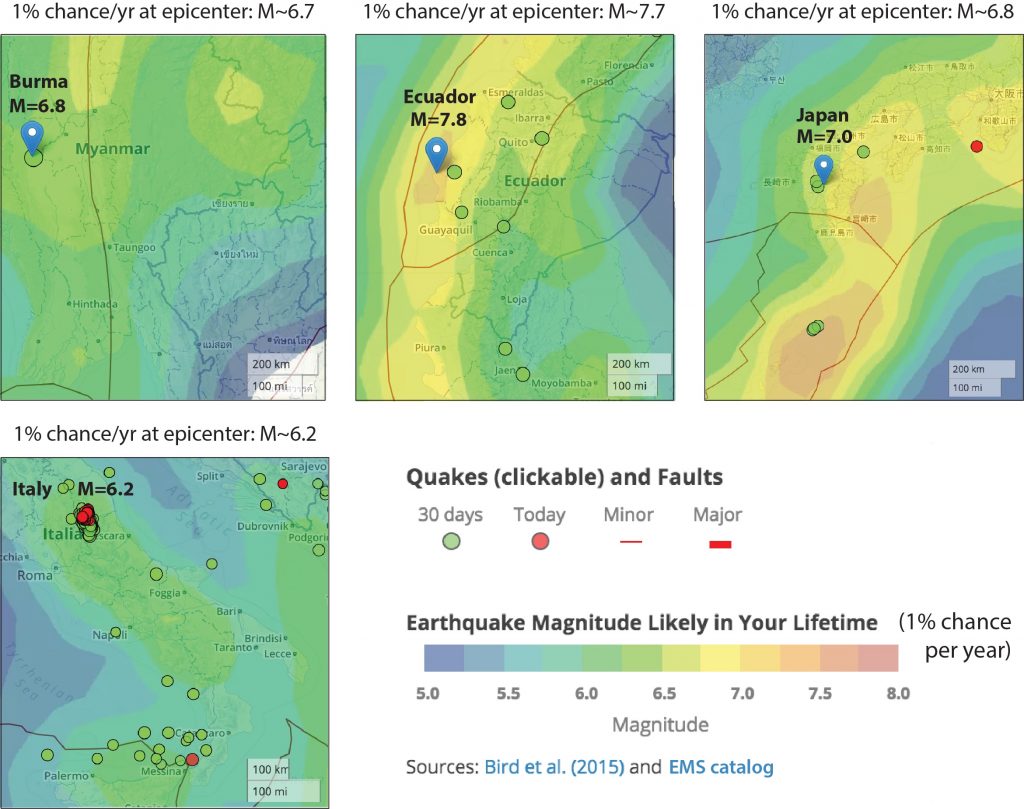

The recent 16 April M=7.0 Japan and M=7.8 Ecuador quakes, and the 24 August M=6.8 Burma and M=6.2 Italy quakes, all fall into the 1% per year occurrence rate, as does the 12-18 August 2016 Louisiana flood. So, these are neither once-in-a-millennium events like the 2011 M=9 Tohoku-Oki quake, nor are they garden-variety shocks like Parkfield earthquake, which has ruptured roughly the same section of the San Andreas fault in central California every 20-40 years since 1857.

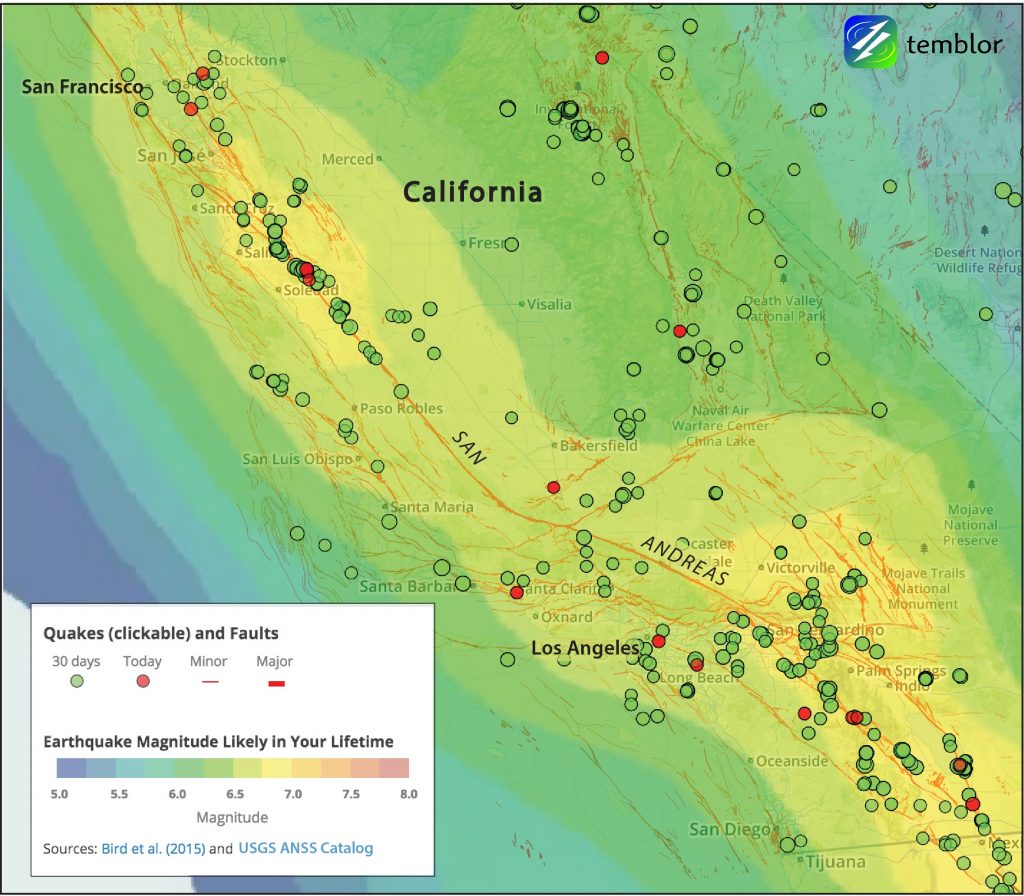

As the distinguished UCLA professor emeritus, David D. Jackson, said about the recent events, “Most earthquakes know where to go—they follow the crowd.” What Dave means is that the rate and distribution of past earthquakes, as well as the straining of the Earth’s surface caused by deep fault slip, are the best indicators of future earthquake behavior. That is why Temblor’s ‘Earthquake Forecast’ layer displays the Global Earthquake Activity Rate (GEAR) model of Peter Bird, David Jackson, Yan Kagan, Corné Kreemer and myself, published in 2015 and now undergoing independent testing by the Collaboratory for the Study of Earthquake Predictability (CSEP).

Cognitive Dissonance

But consider this: If you have a mortgage, and your home lies within FEMA’s 1% chance per year of flood inundation, you are required to carry flood insurance. But earthquakes? Most of us ignore them.

Take a look at the GEAR map for California, above: A M~7 shock has a 1% chance per year of occurring in much of the Southland (greater Los Angeles) and the San Francisco Bay area. But although the lion’s share of buildings are much younger—and therefore stronger—in California than Italian Apennine towns, a M=7 is twenty times more powerful (by released energy) than Italy’s recent M=6.2. In a M=7, we will be shaken about three times harder, and ten times longer.

Earthquakes that strike once in a lifetime are easily forgotten, and catch us unawares. So, the spate of recent destructive global events should remind all Californians that we need to be ready to withstand a M=7 quake. Because if earthquakes do indeed follow the crowd, they’ll be with us again.

Sources:

Earthquakes from the USGS and EMS seismic catalogs

Bird, P., D.D. Jackson, Y.Y. Kagan, C. Kreemer, and R.S. Stein (2015), GEAR1: A Global Earthquake Activity Rate Model Constructed from Geodetic Strain Rates and Smoothed Seismicity, Bull. Seismol. Soc. Amer., 105, 2538–2554, doi: 10.1785/0120150058, Link

- Beware quiet segments of the Philippine Fault - May 16, 2025

-

ډیری عوامل افغاني ټولنې د زلزلې پر وړاندې زیانمنوي

- August 11, 2022 - What’s happening this week in Humboldt County, California: The squeeze - February 6, 2019