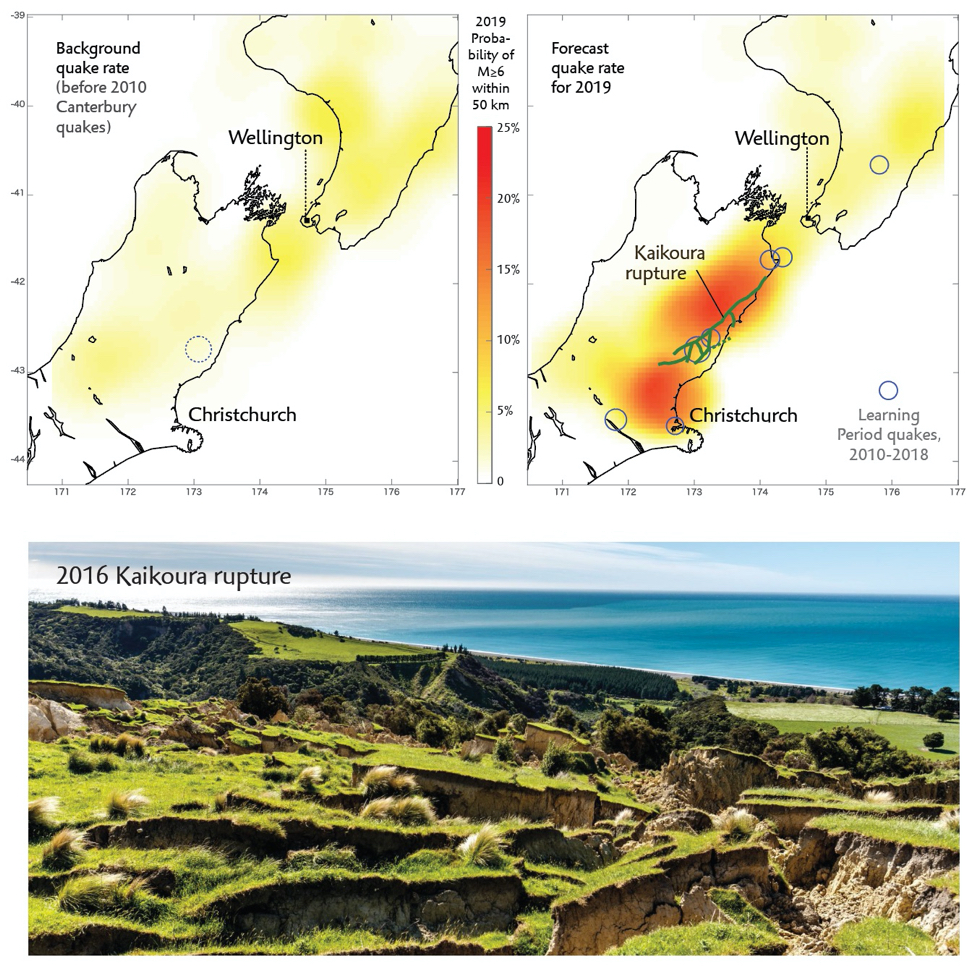

Realtime Risk is a ‘live cat’ tool that accounts for aftershocks, progressive mainshocks, and earthquake rate drops. It is available in two formats: The first is gridded values of forecast earthquake rate changes, or the expected earthquake rates for any period of interest, which can be used to modify a vendor model. The second is an EVENTSET-RtR, an EVENTSET whose forecast is modified for these rate changes.

After a large earthquake, stress transfer from the rupture to surrounding faults changes the earthquake rate and loss exposure. This may significantly alter underwriting or reinsurance needs, or the change of a cat bond being triggered, but is not considered in most insurance models. Temblor’s Realtime Risk solves this by providing a dynamic assessment of potential insurance losses as earthquakes occur. Here’s how it works: Realtime Risk calculates the Coulomb stress imparted to surrounding earthquake focal mechanisms; these mechanisms are proxies for active faults. It then uses the theory of rate/state friction to transform the stress changes into earthquake rates for any time period of interest (e.g., for the period of the hours clause, the sales moratorium, or the next renewal cycle).