By David Jacobson and Ross Stein, Temblor

Since the fall, California has experienced extreme rainfall, leading to flooding around state, and a near catastrophe when floodwaters almost led to the failure of Oroville Dam, prompting the evacuation of over 180,000 people. While California may have dodged that bullet, there are over 7 million residents who live in flood-prone areas. Many carry flood insurance under the National Flood Insurance Program (NFIP) to protect themselves against potential losses; it is mandatory if you live in an area with 1 chance in 10 of flooding per decade, and you have a mortgage loan. However, California is considering pulling out of the national program in favor of a statewide one. The reason: Californians have paid substantially more in premiums than they have received in damage payouts over the past two decades.

This potential move was prompted by research by Prof. Nicholas Pinter at the UC Davis Center for Watershed Sciences. Dr. Pinter looked at the last 21 years of flood insurance premiums and payouts around the country. He found that Californians have paid $3 billion more than it has received. Payouts have been less than 15% of what was collected in premiums. Compare this to Mississippi, which has received 560% of what it has paid. More granularly, only 18 out of 538 California jurisdictions received more money than they paid. This excess money, Pinter argues, could have been spent on flood prevention priorities such as floodplain management like levees and storm drains.

While Pinter raises an important question, it prompts another: Is 21 years of data enough to justify pulling out of the program? As Roy Wright, who heads FEMA’s Federal Insurance and Mitigation Administration points out, a single event can turn a state from a net payer to a net receiver. He uses Hurricane Sandy as an example, where prior to which, both New York and New Jersey were net payers. But the states received over $8 billion in Sandy-related payouts. So, just because a payout hasn’t been received, does not necessarily mean you aren’t getting good value.

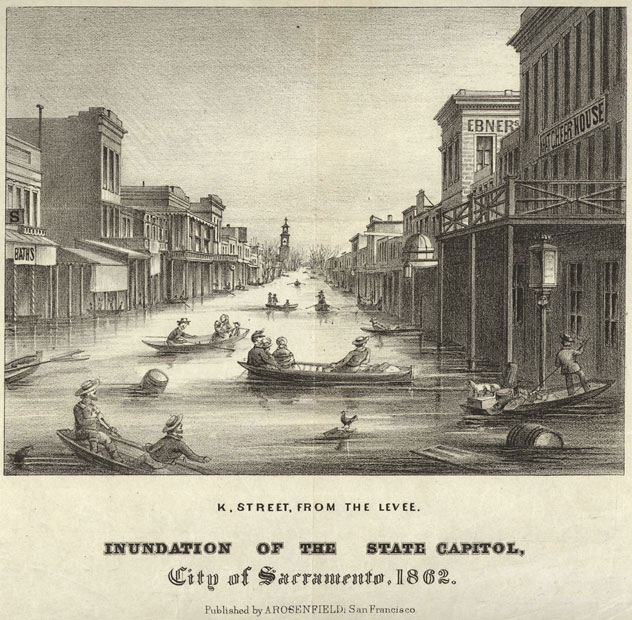

Another issue with only addressing the last 21 years of floods is the ‘power law’ nature of flood intensity. This means that there is no average flood; instead small floods are frequent, and as they get larger, they become more rare. Earthquakes also have this power law behavior. This means that you cannot average short time intervals to get the longterm behavior. For example, the 1861-1862 California floods were massive. The entire Great Valley became an inland sea, and Gov. Leland Stanford (the railroad magnate and university founder) had to be rowed to his inauguration in Sacramento. These extreme ‘atmospheric river’ events are rare but deadly; they are thought to occur roughly every 200-1000 years. Events like this, and Hurricane Sandy, are why insurers depend on a combination of our short historical record, and what they hope are realistic computer models to generate realizations of floods over thousands of years to set premiums.

So, in our judgment, there are two key issues:

• Does the National Flood Insurance Program properly model flood risk across the United States, and are its premiums based on these models? If not, rates should be modified so that no state or urban area is subsidizing another, and so that premiums are based on risk. Since the program is up for reauthorization this year, this should be part of the discussion.

• Second, if California decides to go it alone, its program will need a substantial financial reserve, and so it will have to buy ‘reinsurance’ (super insurance) to cover great floods. The National Flood Insurance Program is $20 billion in debt; California could not carry anything like this debt and remain solvent.

References

Capital Public Radio article by Amy Quinton – “California May Leave Federal Flood Insurance Program And Go It Alone” – Link

California WaterBlog article by Nicholas Pinter, Rui Hui, and Kathy Schaefer – “California, Flood Risk, and the National Flood Insurance Program” – Link

Keith Porter, Anne Wein, Charles Alpers, Allan Baez, Patrick Barnard, James Carter, Alessandra Corsi, James Costner, Dale Cox, Tapash Das, Michael Dettinger, James Done, Charles Eadie, Marcia Eymann, Justin Ferris, Prasad Gunturi, Mimi Hughes, Robert Jarrett, Laurie Johnson, Hanh Dam Le-Griffin, David Mitchell, Suzette Morman, Paul Neiman, Anna Olsen, Suzanne Perry, Geoffrey Plumlee, Martin Ralph, David Reynolds, Adam Rose, Kathleen Schaefer, Julie Serakos, William Siembieda, Jonathon Stock, David Strong, Ian Sue Wing, Alex Tang, Pete Thomas, Ken Topping, and Chris Wills; Lucile Jones, Chief Scientist, Dale Cox, Project Manager, Overview of the ARkStorm Scenario, 2010, Open File Report 2010-1312, U.S. Department of the Interior, U.S. Geological Survey – Link

- Earthquake science illuminates landslide behavior - June 13, 2025

- Destruction and Transformation: Lessons learned from the 2015 Gorkha, Nepal, earthquake - April 25, 2025

- Knock, knock, knocking on your door – the Julian earthquake in southern California issues reminder to be prepared - April 24, 2025